A Large Market with a New Force: The Profile of Chinese Consumers

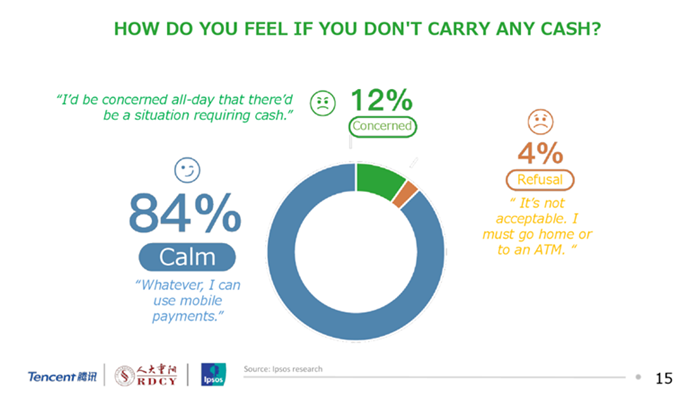

Chinese consumers have been extremely active in recent years, and are gradually making overseas purchases on a regular basis. To help you better attract the large numbers of Chinese consumers with strong spending power, Wiitrans has put together a profile of Chinese consumers based on the research findings of authoritative research firms in China and overseas, including CBNData, Accenture, Deloitte, and Alibaba. Aficionados of online shopping accustomed to mobile payments Figure from National Bureau of Statistics of China shows that the Chinese online retail market was worth up to 7.2 trillion yuan in 2017, an annual growth of 32.2%. The size of the online retail industry is estimated to exceed 18 trillion yuan by 2025, as its share of total retail sales of consumer goods grows beyond 25%. The number of consumers making cross-border online purchases has seen a tenfold increase within a span of three years. A case in point is the 37% year-on-year increase in Black Friday, 2017 sales. Mobile payments (mainly Alipay and WeChat Pay) are also tremendously popular in China. According to the 2017 Mobile Payment Usage in China report, 84% of consumers would be “calm” with living an entirely cashless life. Based on the above, websites, apps, and mobile payments are crucial for appealing to Chinese shoppers. Smarter purchases, quick growth in mid-to-high-end consumption

Owing to developments in the national economy, Chinese consumers that were once “price oriented” are now “value oriented.” 70% of consumers fall in the mid-to-high-end category, and it is increasing each year. While this is good news, Chinese consumers are also becoming increasingly discerning. Safety, materials, quality, and design are just some of the factors that Chinese consumers would consider more when shopping for imported products. As such, brands should provide plenty of information in their product descriptions together with specific details for Chinese consumers. Now more than ever, Chinese consumers need to feel like they can trust a brand and are valued customers of the brand.

Smarter purchases, quick growth in mid-to-high-end consumption

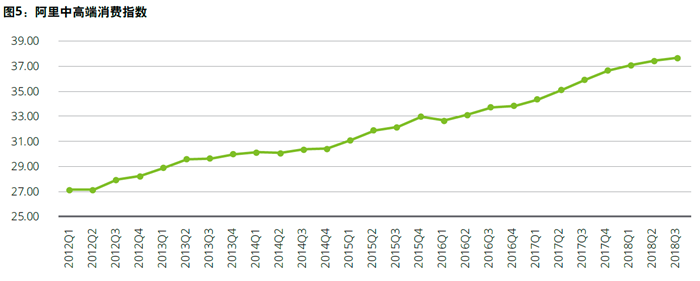

Owing to developments in the national economy, Chinese consumers that were once “price oriented” are now “value oriented.” 70% of consumers fall in the mid-to-high-end category, and it is increasing each year. While this is good news, Chinese consumers are also becoming increasingly discerning. Safety, materials, quality, and design are just some of the factors that Chinese consumers would consider more when shopping for imported products. As such, brands should provide plenty of information in their product descriptions together with specific details for Chinese consumers. Now more than ever, Chinese consumers need to feel like they can trust a brand and are valued customers of the brand.

Alibaba’s measure of mid-to-high-end consumption shows a gradual upward trend from 2012 to 2018

Greater acceptance of independent brands Another positive development is the growing recognition among younger segments, especially those born in the 1990s, of lesser-known brands, niche and trendy brands, brands with original and indie designs, influencer brands, etc. Shoes, accessories, makeup, and household goods are the most popular categories. As such, independent brands that have limited sales in China or are looking to expand their overseas markets could take this opportunity to make their foray into China. High regard for scenarios, experiences, and intelligent services The growing “pickiness” of the Chinese consumer has elevated the product economy into an experience economy centered on key scenarios. Almost 60% of Chinese consumers indicated that “shopping is less about buying the product than it is about buying an experience.” 52% of consumer wanted to experience the products they desired on Augmented Reality (AR) or Virtual Reality (VR) devices. These consumers also hoped that intelligent devices would be able to predict their needs. Starbucks illustrates how this can be done. The Starbucks Reserve Roastery launched in Shanghai in 2017 enables customers to experience what goes into a cup of coffee, with the help of AR technology that adds to the engaging and interactive experience. This took off very quickly in China, and customers had to wait up to four hours to get into the store during peak periods. A reliance on social networking, content marketing is trusted

“Social networking” has become an important stage in triggering purchases in China. Sometimes, social networking even results in unexpected purchases. Most consumers indicate that they are more willing to believe in and purchase products recommended in social network circles. In China, WeChat and Weibo are used in much the same way as Facebook, Twitter, and Instagram. Gain exposure for your products on such platforms is critical. On the other end of the spectrum, much buzz surrounds short video clips and live-streaming platforms in China, some of which feature hosts, similar to YouTube’s beauty vloggers, who have a huge following of fans and very high conversion rates for purchases.

A reliance on social networking, content marketing is trusted

“Social networking” has become an important stage in triggering purchases in China. Sometimes, social networking even results in unexpected purchases. Most consumers indicate that they are more willing to believe in and purchase products recommended in social network circles. In China, WeChat and Weibo are used in much the same way as Facebook, Twitter, and Instagram. Gain exposure for your products on such platforms is critical. On the other end of the spectrum, much buzz surrounds short video clips and live-streaming platforms in China, some of which feature hosts, similar to YouTube’s beauty vloggers, who have a huge following of fans and very high conversion rates for purchases.

(America)

(China)

All in all, when localize into China, foreign brands need to make their presence felt on the various social media channels, interact with fans, and remain active. The massive Chinese market offers no shortage of opportunities but also poses numerous challenges. When choices abound, marketing content and channels to attract consumers is the key. Companies overseas need to provide good-quality products, conscientious service, and in-depth localization to cater to the experience economy in China that is expanding each day. Well-positioned in China, Wiitrans has worked with many companies in line with consumer goods. With our abundant pool of linguist resources, as well as comprehensive and efficient workflows, and self-developed translation and management tools, Wiitrans has the capabilities to provide companies with one-stop language services for content such as product manuals, marketing materials, websites, multimedia content, etc.